Take Your 401(k) Plan to a New Level

As a 401(k) advisor and specialist, I know firsthand how crucial it is to have a solid team backing your retirement plan. Think of your plan like a table – it needs all its legs to stand strong. Your 401k recordkeeper, third party administrator (TPA), financial wellness provider, and retirement plan advisor are those vital legs, each playing a unique role in keeping your plan stable and effective.

As a 401(k) advisor and specialist, I know firsthand how crucial it is to have a solid team backing your retirement plan. Think of your plan like a table – it needs all its legs to stand strong. Your 401k recordkeeper, third party administrator (TPA), financial wellness provider, and retirement plan advisor are those vital legs, each playing a unique role in keeping your plan stable and effective.

Top-Notch 401(k) Plans Don’t Happen By Accident

Let’s face it – managing a 401(k) plan is complex. By leveraging the expertise of service providers, you can ensure critical functions are handled professionally:

- Recordkeeping

- Plan design

- Compliance

- Administration

- Participant education

- Investment selection and monitoring

And the best part? You can access this expertise while keeping costs reasonable.

The Perks of Partnerships

I’ve found that partnering with a knowledgeable team of providers can be a game-changer. Here’s what you can expect:

- Easier plan administration

- Improved plan effectiveness

- Better employee engagement and participation

- More confidence in your fiduciary role

- Employees feeling more financially secure

Remember, though – outsourcing doesn’t mean you’re off the hook for fiduciary duties. We’re still responsible for ensuring our providers deliver value. But these partnerships allow us to focus on our core business while benefiting from top-notch 401(k) management.

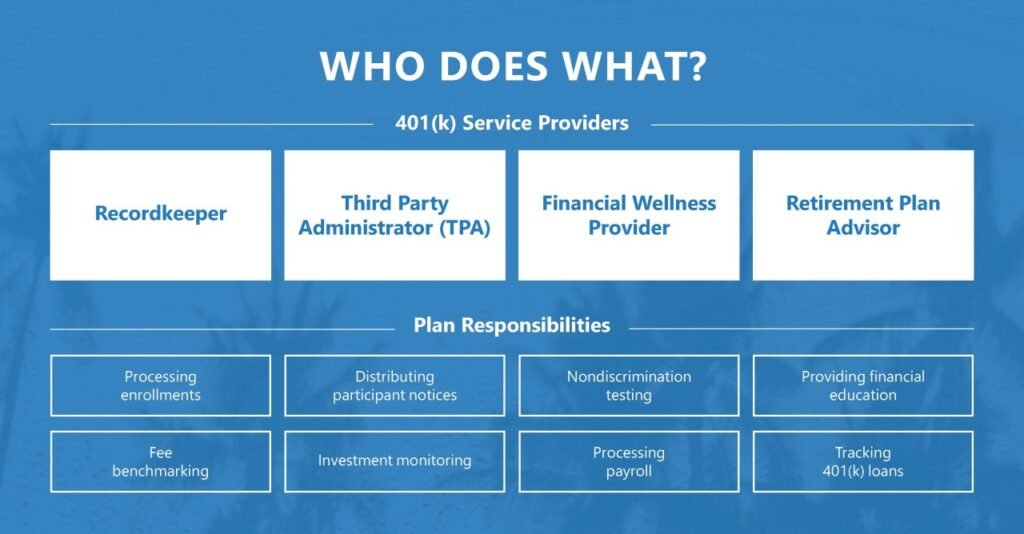

Who Does What?

In my experience, there’s no one-size-fits-all answer here. Different providers have different strengths. Here’s a general breakdown of who might handle what:

Here’s a list of who does what…

401k Recordkeeper

- Processes enrollments

- Manages participant investments

- Tracks contribution sources

- Handles loans and withdrawals

- Generates account statements

- Provides customer support

Third Party Administrator (TPA)

- Manages compliance and testing

- Maintains accurate participant data

- Assists with Form 5500

- Reconciles accounts and errors

- Reviews client census

- Monitors contributions and fees

- Provides plan reviews and audit support

Financial Wellness Provider

- Offers financial education

- Facilitates additional benefits (e.g., emergency savings, student loan assistance)

- Helps reduce employee financial stress

- Can improve employee retention

401(k) Retirement Plan Advisor

- Conducts plan reviews

- Monitors investments

- Benchmarks fees

- Acts as a provider liaison

- Advocates for employers and employees

- Assists with compliance

- Educates on plan design

- Provides employee education and enrollment support

- Reports on retirement readiness

Building Your 401k Dream Team

Remember, every plan is unique. The key is to determine what works best for your business and employees, then ensure your providers meet those needs.

You’re not on your own. I can help you.

As someone who’s been through this process, I can tell you that evaluating your current service providers, their tools, and the value they bring is crucial. If you’re wondering how to optimize your provider relationships, don’t hesitate to reach out. I’d be happy to share more insights and discuss potential partnership opportunities that could take your 401(k) plan to the next level.

Next step: Ready to begin your 401k Improvement Project? Book a meeting below.

Retirement Partners of California Can Help!

We’ll design an Employee Financial Education Plan to help improve your 401k participant results.

Disclosures, Sources, and Footnotes

This information was developed as a general guide to educate plan sponsors, but is not intended as authoritative guidance or tax or legal advice. Each plan has unique requirements, and you should consult your attorney or tax advisor for guidance on your specific situation. In no way does advisor assure that, by using the information provided, plan sponsor will be in compliance with ERISA regulations.

Tracking #625329