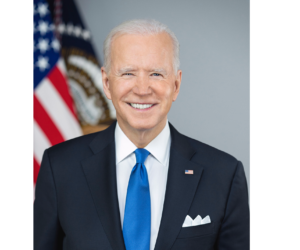

Do you agree with Biden’s ESG bill?

ESG interest and attention seem to have a new friend in the Executive Branch of Government. President Biden’s veto allows retirement plan fiduciaries to consider “other factors” besides financial when analyzing and recommending investment lineups to 401k and other qualified retirement plans.

ESG interest and attention seem to have a new friend in the Executive Branch of Government. President Biden’s veto allows retirement plan fiduciaries to consider “other factors” besides financial when analyzing and recommending investment lineups to 401k and other qualified retirement plans.

Retirement Plan Fiduciary Decision Process

ESG attention has resurfaced as an important political hot-potato. ESG interest and attention has risen to the prominence it once held during the held during the two prior administrations. No longer are prudence, return, and duty of loyalty rule the decision process for retirement plan fiduciaries and ERISA investment committees.

Those principles and mandates are being supplanted by Environmental, Social and Governance guardrails.

The Biden Administration has made clear the acceptance of exogenous factors when investment managers and retirement committees perform oversight on the assets being managed within a qualified retirement plan. At issue, the primary duty of a retirement plan investment strategy. For years, retirement committees concentrated on pecuniary interests as the primary driver in the selection of plan investments. This is no more.

Do you agree that ESG should be considered in the investment selection process?

Retirement Partners Can Help

SECURE Act 2.0 is more comprehensive than what is outlined above, but these are some of the key areas of interest that could impact businesses. Retirement Partners of CA can be utilized to help your business take advantage of implementing and managing a retirement plan.

Disclosures, Sources, and Footnotes

For plan sponsor use only, not for use with participants or the general public. This information is not intended as authoritative guidance or tax or legal advice. You should consult with your attorney or tax advisor for guidance on your specific situation.

Approval 1-426701